Andhra Bank Financial

With the industry because it’s the price of home is very high as compared to income people generate. You’ll find hardly any people that have enough money a house entirely on their own while some need to have the assistance of home loans to shop for their dream household.

Andhra Bank among the greatest finance companies in Asia will bring home financing within competitive rates making it possible for many in order to get their domestic.

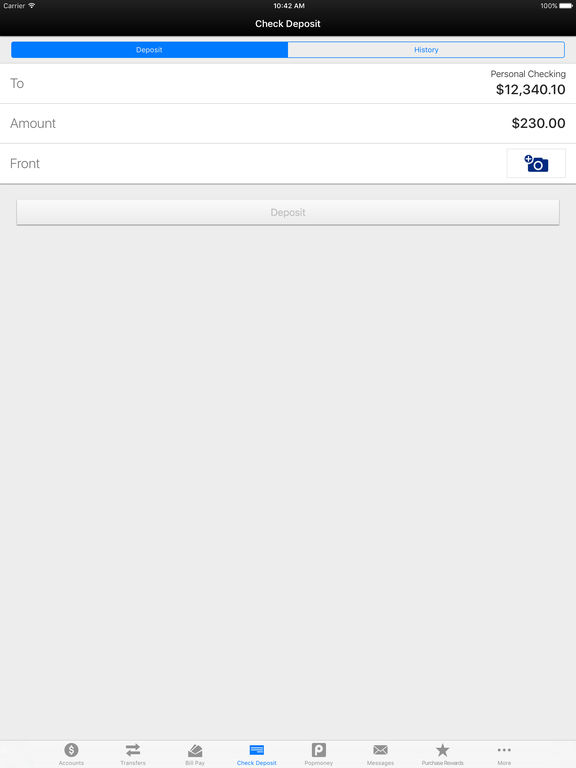

Bringing a home loan regarding Andhra Lender is very simple in which you need to just use the internet visit their website click on financial and you will submit the facts expected. Established customers may pre-approved finance centered on its salary and you will credit history.

All facts about the home loan that are included with interest, EMI count, processing charge an such like. try informed in advance and you may come to a decision to go for the mortgage. Just after, you may have accepted, the mortgage amount is disbursed on bank account instantly.

Once we demonstrate on the analogy over following tenue has been accomplished and you’ve got reduced the attention and you can amount borrowed entirely, you will want to proceed to see a certificate of the same regarding the lender, in this instance Andhra Financial.

The financial institution will have reported your commission over the tenor to the fresh new five credit agencies from inside the Asia and you may adopting the achievement from the loan the same will be reported into bureaus and you may perform soon echo in your credit report. Brand new agreement regarding the lender in addition to meditation of the house loan while the a closed membership try research that you have entirely settled your house loan. Hang in there plus don’t skip people fee, lenders fundamentally is lasting finance.

The newest Andhra Lender home loan recognition & confirmation techniques is easy and far less to have established Andhra Financial users. They’re able to pertain on the internet and get pre-acknowledged offers toward lenders having glamorous rates of interest. The mortgage matter was personally credited to their membership quickly.

The application form procedure differs for brand new customers. The fresh new debtor needs to sometimes pertain on line otherwise in person download this new form regarding the formal website otherwise check out the nearby financial department. They can also call the brand new Andhra Financial mortgage customer care so you’re able to proceed with the app process.

Essentially, bank’s representative will come toward office or your the home of collect the new filled inside the application as well as the fresh necessary records required for confirmation anytime your identify. A back ground have a look at do increase the financial understand the private, professional standing of the candidate In the event that there are one discrepancies with all the information provided, new Andhra Financial financial software is apt to be declined. Just after passage because of document confirmation and you may eligibility requirements, the newest recognition processes movements into last peak. During the final phase and you can immediately following transactions, the Andhra Financial mortgage interest and you can tenure is repaired and you can delivered for the acknowledgement.

If the home loan app try denied might discover Andhra Bank loan getting rejected page that can found a position upgrade towards the financial rejection. Let us know see what this new eligibility or qualifying requirements is because they are entitled during the banking parlance to have a mortgage.

Eligibility Conditions One to Dictate the newest Acceptance regarding Andhra Lender Home loan

One of the primary and primary situation a mortgage candidate have https://elitecashadvance.com/payday-loans-ca/ to do are view their credit score. One bank, when it gets that loan or bank card application often remove the actual anyone credit rating you’ll find with the borrowing bureaus performing in the country.