- FHA Loan Constraints: Speaing frankly about the usa Institution out of Construction and Urban Advancement the latest limitation amount you can obtain relies on the expense of construction when you look at the a certain city. To possess affordable components the newest limitation try $420,680 as well as highest rates section the fresh restriction is $970,8000. That it varies by the state and condition.

- Residential Have fun with: FHA finance are only relevant getting land and won’t become granted so you’re able to resource otherwise trips functions.

- FHA Check: Prior to being approved to own an enthusiastic FHA mortgage a keen FHA appraiser tend to evaluate the property based on a couple of cover assistance.

Discover far more conditions that will be additional by the loan providers to your finest of them required for an enthusiastic FHA loan, it is important to take advice from numerous loan providers to see which bank will probably be your better fit.

Va Financing | 580-620

Since Va claims its money against losings, mortgage lenders bring Va loans at suprisingly low-rates, quite often they are the lowest interest rate money available.

Virtual assistant finance together with do not require a down payment which means financial are 100% of the house rate. But in purchase discover an excellent Virtual assistant mortgage a certification of Qualification (COE) required.

USDA Money | 620-640

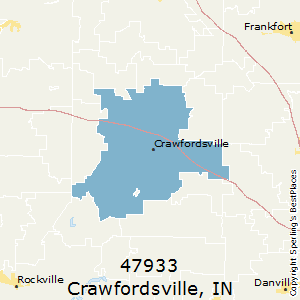

USDA mortgages are around for belongings outside of densely inhabited regions of the us. Despite the fact that, USDA financing will still be appropriate to around 90% of the result in the united states.

This may involve rural areas, quick places, and some suburbs, but exclusions can be made to own home buyers that have extenuating activities. USDA loans eg Va money do not require a deposit, and on mediocre the interest rates will likely be 0.5% less than old-fashioned money at any given time.

Jumbo Financing | 700+

Jumbo loans is to have home buyers whose mortgage loans are way too highest on regional home mortgage limitation. There isn’t any certain credit history need for a good jumbo home loan, but large results are more inclined to be accepted.

Very lenders need a credit rating regarding 700+ in order to be qualified. Virtual assistant Jumbo fund is generally offered at credit ratings away from 640 and significantly more than. In order to be tasked less interest it is better to help you count on trying to find a get regarding the 700+ assortment.

Jumbo money can be used for many different possessions designs, and have been useful no. 1 homes, together with entertainment properties such as for instance trips homes, or qualities one act as a financial investment.

In today’s economic climate it. will probably be you discover your self losing short of the mandatory borrowing otherwise https://simplycashadvance.net/title-loans-ky/ Fico get required for a mortgage. But not all of the is not forgotten, you can follow certain assistance which can definition simple tips to has actually the credit purchasing property.

Courtesy after the a number of simple steps you could potentially replace your borrowing from the bank rating of the a lot when you look at the a brief period of energy. Two things that will help improve your credit history tend to be: looking after your stability on credit cards lower (below 30%), spending all of your costs on time, and you will opening brand new membership that may report beneficially on credit bureaus.

Next it is vital to allow your useful membership adult during the an excellent status, that have long reputation for timely commission record and you may in control need gets your credit score improving immediately.

- Financial obligation in order to Earnings Ratio (DTI): In order to determine DTI sound right any monthly obligations repayments and divide the entire because of the terrible amount of income you get per month and you will multiply they by the 100 for a percentage. In order to qualify the DTI should be no bigger than 50% which have a fantastic in the latest forty%-45% diversity.