You will be breaking assets, outlining the challenge for the high school students, and figuring out the method that you need to live in the brand new phase out-of lifestyle. If that just weren’t hard enough, racking your brains on what the results are towards Virtual assistant financing just after a splitting up contributes an entire most other layer from difficulty.

This is because Virtual assistant mortgage professionals have very particular laws and regulations on whom can hold the borrowed funds and you will whether they live in the home.

Getting a divorce wouldn’t constantly physically affect your own mortgage, but chances are it will apply at your bank account-and perhaps what you can do and also make your own monthly installments.

Consider it. You’re probably maybe not will be combining your revenues and come up with mortgage repayments since you happen to be separated. Even although you was indeed the primary earner along with your spouse existed yourself to view the fresh students, chances are they are going to need to go back into performs and you both will need to separated childcare will cost you to help you accommodate one.

Talking about breaking costs, alimony and you can child service might today become expenses either to arrive otherwise losing sight of your bank account every month.

Do you have to refinance the Va loan?

Since your home is probably a discussed resource, to begin with you have to do are find out having likely to keep it as well as how the other person is certainly going are settled toward death of one investment.

Imagine if you are going to keep your household and your spouse is about to select yet another place to real time. You might have to re-finance your loan so you’re able to a) ensure you get your partner’s name from the financial and action and you may b) decrease your monthly installments which means your budget is more achievable.

In case your Virtual assistant loan is in their identity

In this condition, you are the fresh new experienced, your removed the latest Va loan, and everything is in your term. High! Which makes some thing a bit less challenging.

If you find yourself however able to make the borrowed funds money, then there’s zero pressing factor in that re-finance the loan. You are going because of certain large individual and you can economic transform right now, so it will be smart to look on rates of interest close by in any event.

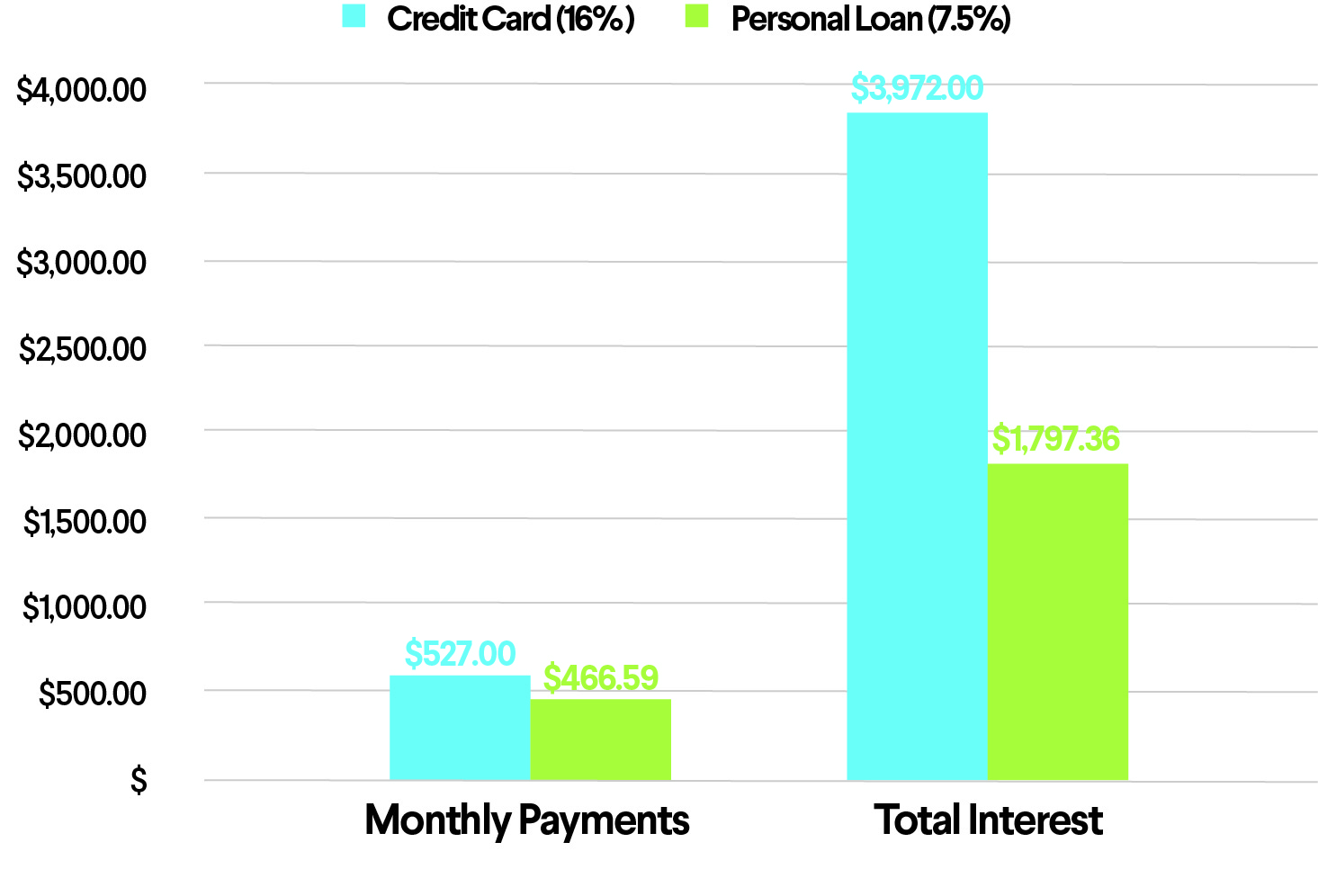

While you’re determining yet another finances and you can to make preparations having lives immediately following breakup, it could be a good time in order to re-finance whether it usually decrease your monthly obligations otherwise reduce steadily the lifetime of the loan.

Think of, you’ll find costs of the refinancing, therefore be sure you basis those who work in after you assess whether or not or not its a very good time so you can refinance.

In case the financing is during your identity, however you you would like the lover’s earnings to make the percentage

In cases like this, you are probably gonna need certainly to speak about refinancing so you’re able to decrease the payment. Guarantee your own lender try offered one alimony and you can child care repayments him/her have a tendency to owe you because these matter once the income and you can can be used to make the mortgage repayment.

Make sure that your the newest payment per month is something you feel comfortable investing every month. If it is not, then you may be interested in promoting your house and you may both renting or to acquire one thing shorter.

If the loan is in their lover’s term

In this instance, your ex lover is the experienced and since they’re not heading to-be lifestyle there, they will not meet up with the occupancy need for Virtual assistant loans. You’ll need to see a lender who’ll make it easier to re-finance off a good Virtual assistant financing in order to a conventional loan.

Ideas on how to refinance your Va mortgage

When you’re an experienced therefore want to refinance your existing Virtual assistant financing, then you can make use of the Interest rate Cures Refinance loan (IRRRL) program. Otherwise, you could choose re-finance their Va mortgage into a timeless mortgage. If you decide to refinance, you may need:

- Spend stubs

- W2s, taxation https://www.clickcashadvance.com/personal-loans-md/ statements, and you may 1099s

- Evidence of homeowners insurance

- Identity Insurance policies

- Credit file

- Proof of most other current assets

- Loans statements (are automotive loans, student education loans, current mortgage loans)

- Certification out of Qualifications (if you find yourself having fun with an alternate Virtual assistant mortgage)

There is a lot to take into account with regards to refinancing your own Va loan shortly after a divorce or separation. However with a tiny think and lots of effort, you will end up getting somewhere high!

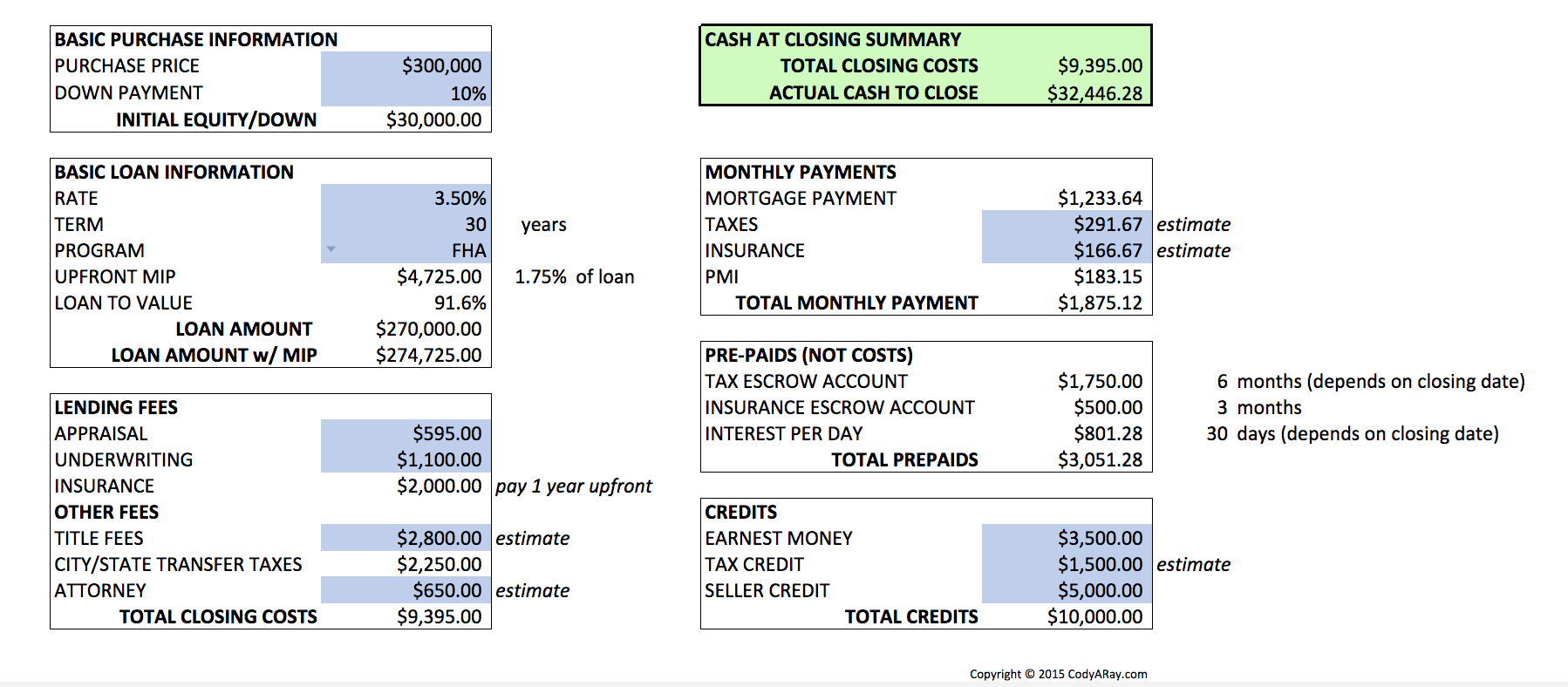

Learning your own monthly payment

I imagine you will be. Have fun with our very own Virtual assistant Finance calculator right now to get a grasp on the just what taxation, insurance coverage, and you will Virtual assistant capital charge looks such as according to the sorts of of Va mortgage that you are taking right out, with other items.