Several lenders offers mortgage possibilities when one-day away from discharge

- Begin using borrowing again slowly. Bringing a credit card immediately following personal bankruptcy will likely be difficult, but you’ll find choices for your. Avoid using excess credit too fast, nevertheless is to bring quick methods on reconstructing your credit score by paying costs promptly and starting a protected credit card.

- Steer clear of the same financial errors that had you toward this situation. When you are eligible for home financing, lenders can look from the the reasons why you experienced this example and you may try to end if this is probably recur. It is the difference in the being qualified for a financial loan or not.

Bankruptcies is actually released at differing times with respect to the sorts of. A chapter 7 case of bankruptcy is sometimes discharged from the five months (typically) once you file. not, Part thirteen bankruptcies can drag for the having longer because you will be anticipated to repay their arranged cost package. Tend to this type of bankruptcies is actually discharged less than six many years pursuing the Section thirteen bankruptcy is registered.

New closer you can bankruptcy discharge, more happy you will likely become for this time off lives trailing you. But this isn’t whenever so you’re able to skip your bank account. In fact, brand new 6 months prior to the case of bankruptcy launch might be crucial for debt upcoming.

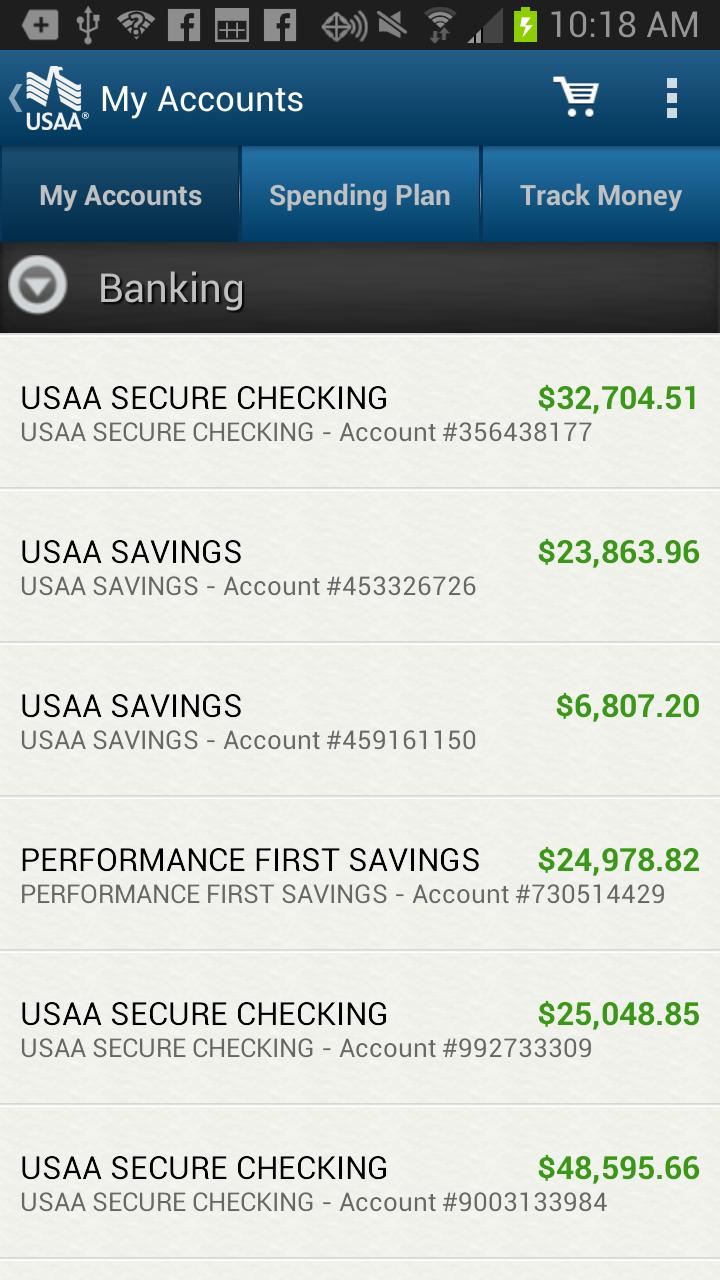

Several lenders will offer you financing solutions when 1 day from launch

- Reassess your finances. You should be keeping track of your credit report and you will staying on top of your cover the length of your bankruptcy. But 6 months before launch, you are able to reevaluate your finances and you can bills. Be certain that you’re setting yourself up for profits due to the fact launch happens as well as your bankruptcy proceeding percentage falls off.

- Remain rescuing. Now is not the time to end preserving your money. More deals you have got immediately following your bankruptcy proceeding discharge, the faster it will be possible to track down back in your ft.

- Review credit history getting precision. A couple of times, wrong suggestions would-be indicating on your credit history that could prevent you from qualifying otherwise reduce your own closing.

- Remark predischarge publication to get more wisdom. Look at the Book

Ideas to let your money 0-12 months shortly after bankruptcy proceeding launch

Very, you’ve eventually had your own bankruptcy released. That is a big time for everyone. Well-done! You really need to currently have a far greater month-to-month earnings and you may a bona-fide sense of accomplishment. You are payday loan Lazear today probably eligible for certain financing apps, however, many lenders will still have tip overlays that require an effective one- or a couple-seasons wishing attacks. Traditional and you may Jumbo funds will not feel offered until you is 2-4 many years early in the day launch.

A few loan providers will provide financing choices once one day away from discharge

- Continue a great patterns. Don’t let the discharge of your case of bankruptcy allow you to slide returning to bad financial models. Stick with good budget, spend your costs promptly, and you may slower reconstruct your credit rating.

- Screen your credit history. Knowing in which your credit rating stands is a great cure for make sure your finances are designed up correctly. Of several banking companies otherwise creditors have borrowing from the bank overseeing apps to own totally free. Make use of them to stay at the top of their credit in this essential big date.

- Keep the case of bankruptcy records. Of the 12 months immediately following a bankruptcy launch, you’re tempted to dispose off your case of bankruptcy documents. Never do that. This files will come in convenient if you are ready to apply for a home loan.

- Do your best to remain in a reliable home and work. Keeping a reliable household and occupations can help let you know financial institutions you to definitely you are a secure choice. Both things happen and you can homes otherwise operate have to be kept. not, make your best effort to keep a reliable house and you can job problem towards first few many years shortly after your bankruptcy proceeding release.