Conversion process quantities is actually off, but home prices is holding good. The new U.S. housing industry possess sent combined indicators in recent months, and you can Nevada is actually following that pattern. Regarding the Las vegas area urban area, home prices soared within the pandemic growth prior to move into later 2022, since mortgage costs leaped.

We create money that produce experience

Now, since consumers conform to the newest facts of your own real estate benefit, the fresh new Vegas housing market is moving on again. The new average price of solitary-household members property available in this new Vegas city urban area for the peak, with regards to the Vegas Real estate professionals. (The Las vegas town city makes up about nearly around three-house of the nation’s society.) And also the city area’s catalog is actually off 38% year over season.

If you’re Nevada’s pace regarding rate fancy have slowed down as compared to pandemic boom, provides is actually rigorous, and you will providers are sense good need for features. The state’s mix of a robust savings and you can glamorous taxation setting that Nevada will continue to desire consumers from all around the country.

Instance, anywhere between , Nevada experienced a populace development of more than 73,000 citizens, as reported by the newest U.S. Census Agency. In contrast, California watched an effective elizabeth timeframe.

Nevada’s economy has been regaining the footing following pandemic. The country’s jobless rates of 5.4 % was the highest in the united kingdom as of , based on Work Agencies investigation. One to sad pattern keeps kept once the pandemic when Nevada’s tourist-heavy savings is actually struck by the casino closings getting the majority of 2020.

And the fresh housing industry keeps tossed direct fakes, so features Nevada’s discount. This new Gold County may have the nation’s high unemployment speed, but it also met with the strongest jobs increases for the twelve days finish during the . Employment longer by a robust step three.cuatro percent. (For the , Nevada’s gains was still 3.4 percent, however, Idaho’s step 3.5 % progress try higher.)

Regardless of the present combined overall performance, Nevada’s housing marketplace has been in an extended-title growth. Regarding 1991 from the third quarter regarding 2023, Vegas home values possess risen 294%, according to the Government Homes Money Government.

Good productivity has actually inspired demand for Las vegas, nevada house, especially among investors. In one promising signal to possess landlords, belongings was expensive for most local experts, an actuality that induce demand for local rental construction. As of the third quarter out-of 2023, only fifteen per cent out-of belongings offered was about price range from a median-money nearest and dearest into the Las vegas, according to the National Relationship away from Home Developers/Wells Fargo Construction Possibility Directory. Inside the Reno, only 19 per cent regarding belongings purchased in July, August and you can Sep had been when you look at the visited of median-income customers.

Sales amounts was off, in addition to housing industry is within transition. That implies handling a mortgage spouse you can trust was more critical than in the past. LendSure desires increase company in Vegas. We are able to sign off into recognized exceptions rapidly along with simplicity.

- Non-warrantable condo finance. When Fannie mae and you will Freddie Mac uncovered the fresh recommendations from inside the 2022, it roiled brand new condominium lending market. At the LendSure, we pleasure our selves on the freedom in place of thoughtlessly sticking with rigid laws. If you enjoys a borrower whoever condominium contract will not qualify in agencies’ rigorous rules, we can improve offer happens. LendSure’s sound judgment legislation accommodate approvals off condominium products that are denied from the firms.

- Condotel fund. Las vegas try a distinguished hotspot to own condotel financial investments, and is also now so much more accessible to borrowers trying funding alternatives. Which have LendSure’s certified condotel fund, investors can also be with certainty explore opportunities throughout the surviving Vegas home sector payday loans Aristocrat Ranchettes no bank account.

- DSCR loans having funding characteristics. LendSure’s loans-services publicity proportion (DSCR) system try modify-made for possessions traders. LendSure’s commonsense strategy setting we find ways to state yes. For example, unlike offered just current rental earnings within our underwriting, LendSure qualifies the house or property by thinking about markets rents. Inside our more versatile strategy, LendSure underwrites brand new investment property considering one another newest and you may upcoming rent. Having a reason of your DSCR money, come across a quick movies. At the same time, LendSure has grown their DSCR program outside the normal that- to help you five-devices i create DSCR financing for the attributes having around 7 devices.

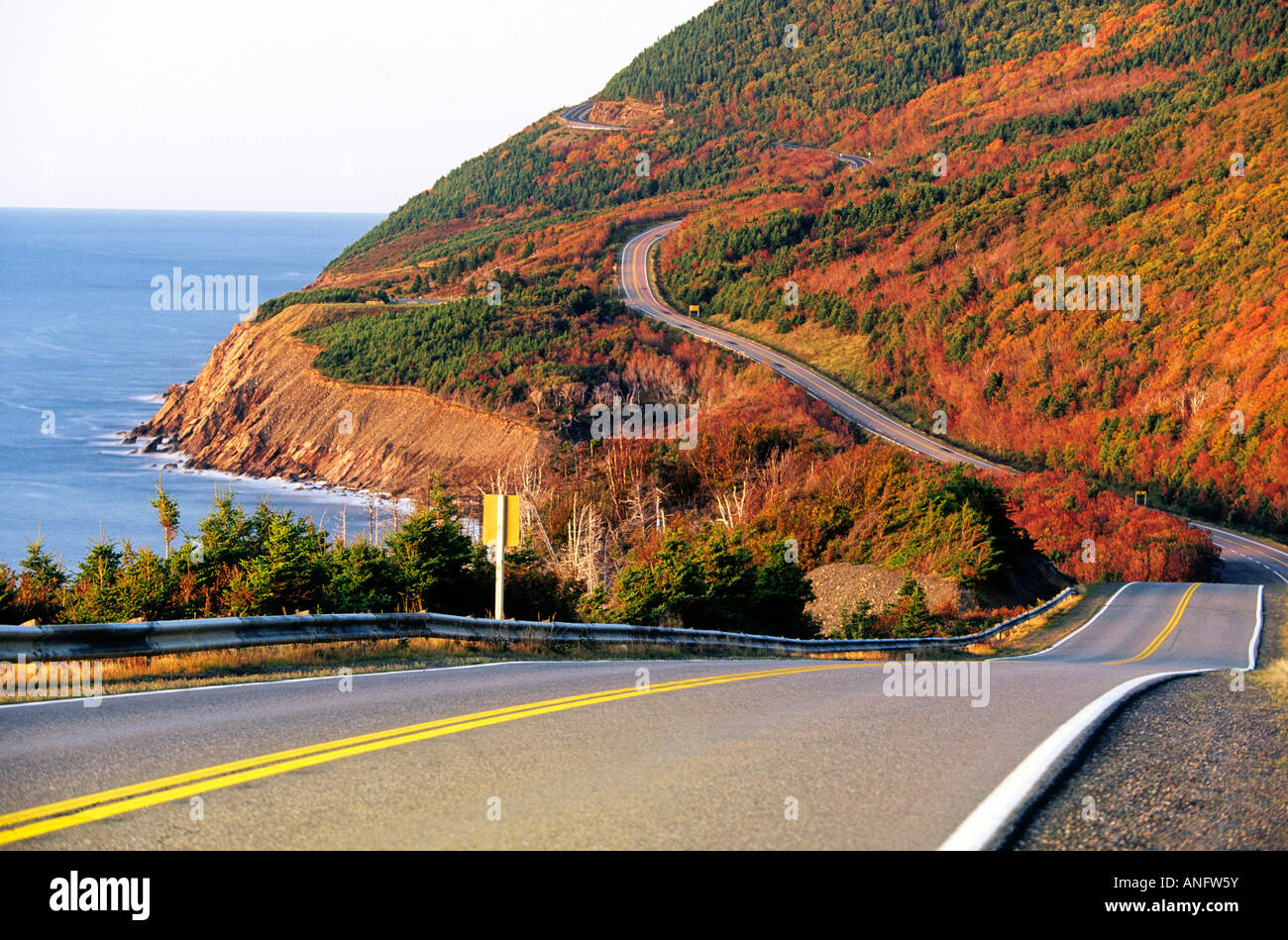

- 2nd residential property. Nevada’s gambling enterprises, pure portion and you may ski lodge suggest the state try an appealing place to go for second home buyers. To help you meet the requirements of these important customers, countries also offers a full array of fund to possess 2nd land and funding characteristics, along with full doc and you can lender declaration loans. Mortgages are available for up to $dos billion or over so you’re able to 80% LTV.

Its easy. We are really not in the-the-package loan providers. I bust your tail provide all of our commonsense deal with financing in order to individuals looking to money with the family of its aspirations, a unique addition on their investment property collection, otherwise refinancing out of a currently had assets.