A mellow credit assessment, or mellow credit pull, try a credit query this is simply not linked to a certain software having borrowing from the bank, like a good pre-acceptance having a credit card otherwise whenever an employer conducts good background see. Silky inquiries try not to feeling your credit score, whereas tough inquiries, hence occurs once you incorporate in person having a unique collection of borrowing from the bank, ount of time.

When searching for yet another credit line, evaluate cost which have flaccid borrowing from the bank monitors and you can pre-approvals as opposed to full applications. Rate looking is a superb way of getting a knowledgeable price for the a home loan, credit card, otherwise education loan refinance-it permits you to know exactly what various other lenders have to offer rather than being forced to glance at the full application procedure. This may help you save money into desire, and also you need not worry about several hard issues affecting sites for loan in Rockville Connecticut your credit rating.

Starting a special credit line have a tiny feeling on the credit history. This can be for most factors, together with a difficult inquiry on the account or even the average age of your own levels. A small credit rating dip shouldn’t stop you from making an application for home financing or refinancing your own figuratively speaking, but it’s one thing to bear in mind in relation to beginning a beneficial the newest line of credit.

How your credit rating is computed

Fico scores will be the most widely used credit scores. Such scores may include three hundred to help you 850, in addition to highest their rating, the newest less chance your give loan providers. Listed here is a summary of an important activities which go into the FICO rating, and guidelines on how to boost each one:

Payment background (35%):

This is basically the most important factor on your own FICO score. Lenders want to see which you have a reputation and then make on-date payments, very later costs will ruin your get. To evolve your own percentage history, continue to pay your expenses timely.

Credit application (30%):

Which refers to the level of obligations you happen to be carrying compared to the credit limitations. Loan providers want to see that you are having fun with a small percentage of your own offered credit, very maxing your credit cards usually ruin your own get. To switch your own credit utilization, play with lower than 30% of full borrowing limit.

Credit score duration (15%):

A longer credit score suggests in charge credit choices throughout the years, very which have an extended credit history often increase get. If you don’t have a lengthy credit history, there is not much you can do regarding it factor except so you can be patient and you may continue using credit sensibly.

Borrowing mix (10%):

This refers to the particular borrowing levels you really have, and revolving levels particularly credit cards and you will payment loans for example mortgages or auto loans. Lenders generally look for a combination of different varieties of account while the confident.

This new credit (10%):

As soon as you unlock a new membership or get an inquiry from a lender, it will ding your own score quite. A good amount of present activity, such as for example beginning several the new levels, may also code chance to a lender and you can impact your own credit score. If you are intending on the obtaining financing in the future, usually do not open one the newest profile or receive any the latest issues from the days leading up to your application.

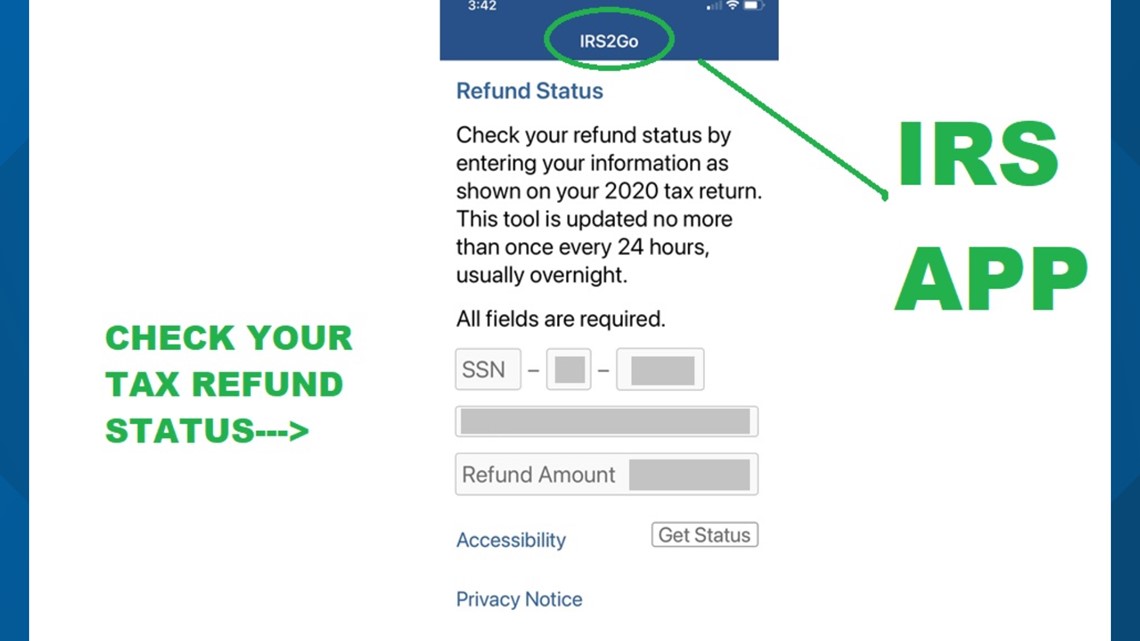

Track your credit score

You can get their complete credit history of all the three biggest credit reporting agencies: Experian, Equifax, and you may TransUnion. You will be permitted one totally free report regarding for every agency every year. You could remove them all at once otherwise stagger all of them through the the entire year to evaluate your borrowing with greater regularity.

Of several banks and you can credit card companies bring constant borrowing monitoring. This permits one visit your score and lots of of your own items impacting it in the event that you require. This type of score is updated month-to-month, therefore you’ll instantly determine if there is any craft on the account which will signal identity theft & fraud.